On 23 October 2015, the research project ‘Weather Index Agricultural Insurance for Ethiopian Farmers’ held a one-day kick-off and knowledge sharing workshop in Mekelle, Ethiopia. The project, which is funded by the Netherlands Ministry of Foreign Affairs through NWO-WOTRO, brings together a consortium of researchers and practitioners from Lingnan University (Hong Kong), Wageningen University (the Netherlands), Mekelle University (Ethiopia), the International Research Institute for Climate and Society (IRI) of Columbia University (USA), the Relief Society of Tigray (Ethiopia) and Nyala Insurance Shareholding Company (Ethiopia) to provide scientific and policy recommendations on the use of agricultural weather insurance in the Ethiopian Productive Safety Net Programme (PSNP). Specifically, the project will compare three groups: Poor households receiving benefits from the PSNP; poor PSNP households also receiving weather index insurance; and poor PSNP households receiving additional conditional cash transfers.

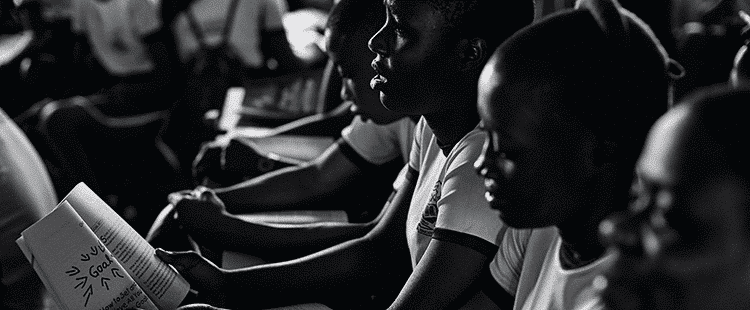

The workshop is the first in a set of efforts to create a casual platform for different stakeholders to share and engage in the project. Nearly 30 participants attended, including local and regional policy-makers, academic researchers, practitioners from non-governmental organizations, officers from regional and national development agencies, and insurance business sector professionals. The workshop began with welcoming remarks by Mr Girma Tegene, Dean of the College of Business and Economics at Mekelle University. A presentation was then given by Dr Zenebe Gebreegziabher, Assistant Professor of Economics at Mekelle University, and Mr Haftom Bayray, PhD candidate at Lingnan University and Assistant Professor of Economics at Mekelle University, who presented the policy background, objectives and plans for the research project, which will take place over two years. After the presentation, participants provided feedback and raised interesting questions for further consideration and the refinement of the project.

A panel session then took place, consisting of four speakers representing different stakeholders in the research project. The panel began with Mr Solomon Zegeye, Micro-insurance Manager of Nyala Insurance SC, who shared his experience in the design, implementation and pricing of weather index insurance in Ethiopia. Mr Desta Gebremichael, Head of the ERAD Department of the Relief Society of Tigray, a regional non-governmental organization, then discussed the adverse impacts of climate change, the need for holistic risk management and the potential for incorporating weather index insurance in national social protection efforts. Mr Berihu Tafere, Officer of the Productive Safety Net Programme in the Tigrai Board, followed with an overview of the Programme in the Tigray region. Lastly, Mr Gebreegziabher Bezabih, Officer of the Credit and Savings Coops Core Process in the Tigrai Coops Promotion Agency, shared his knowledge on Credit Life and Savings Insurance in Tigrai. The panel session was followed by a lively discussion.

The workshop produced insights and helped the research team to identify knowledge gaps that the research project can fill. It provided the research team with more information about the current policy debates and connected them with policy-makers and development officers at the local and regional levels. These interactions will certainly help to bring about further synergies with various stakeholders throughout the research and policy-shaping process. The research team pledged to continue to hold knowledge sharing workshops in the future and update local and regional stakeholders on the progress of the research project.