The evidence base for the positive impact of cash transfers on inclusive development is overwhelming, and still increasing. In the meantime, policy discussions on nationalized social protection in Africa are turning from asking ‘if’ to ‘how’: drawing on insights from programmes that integrate cash transfers with other social policies. These ‘cash+’ programmes seem to be the road ahead in expanding social protection in Sub Saharan Africa.

The recent Transfer Project workshop, which took place in Arusha, Tanzania in April 2019, illustrated how the evidence on the various ways in which cash transfers contribute to social and economic development is stacking up. The vast majority of studies shared in the workshop show how the various intermediate indicators of economic development, such as nutritional status, household resilience, women’s empowerment and the possession of productive assets, are improved through cash transfer programmes. These benefits are not only enjoyed at the household level, but spill-over effects also contribute to the development of local economies and communities.

To read more about the findings discussed in the workshop, see:

– A video of the top 10 takeaways from the workshop

– The Transfer Project website, containing all presentations and a workshop summary

– INCLUDE’s poster presentation at the workshop: ‘Improving cost-effectiveness of social protection through better coordination and implementation’, based on findings of the 7 research projects on social protection in INCLUDE’s RIDSSA research programme

From evidence…

This positive image of cash transfers aligns well with the conclusions of INCLUDE’s synthesis study on the contribution of social protection to inclusive development in Sub-Saharan Africa and the conference ‘Social protection for inclusive growth in Africa’, hosted by INCLUDE and the Economic Policy Research Centre (EPRC) in Kampala, Uganda on 21 June 2018. Both the synthesis study and the report show the need for a change in thinking about social protection as a mere safety net, towards seeing it as a driver for social and economic development.

This apparent consensus on the various benefits of social protection should not stop us from undertaking new research on the conditionalities for effective and inclusive social protection. There is still a large demand for research on effective policies, albeit with slightly changing priorities. Some of the issues identified in INCLUDE’s synthesis study are:

- The long-term benefits of cash transfers and other forms of social protection

- Effective governance, including cooperation with the private sector and civil society

- How complementarity between various social (protection) policies can be increased

- What modes of social protection best benefit the extreme poor and marginalized people

- Context-specific studies, focusing on spatial and social equity

- What types of social protection policies have the best cost-benefit ratios

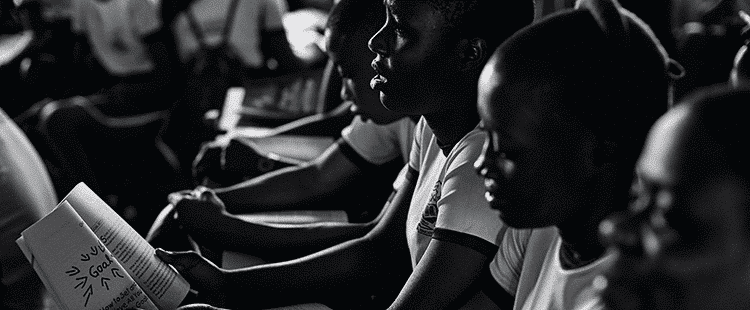

Knowing that social protection works, a central question is: for whom does it work? To answer this question, research needs to continue to carefully examine the various mechanisms driving lack of impact, exclusion from programmes and unintended negative consequences. For instance, effective programmes that are ‘gender blind’ are likely to increase, rather than decrease, gender inequalities. Moreover, while cash transfers can reduce the economic need for child labour, they can also increase or maintain the need for child labour. Using an ‘inclusiveness lens’ in research, including focusing on the specific additional constraints of women and other vulnerable groups, becomes even more essential in the context of rising inequalities in Sub-Saharan Africa.

…through action…

In their 2016 book From Evidence to Action, FAO and UNICEF showed the evidence base on cash transfers, which in the past was predominantly built on studies in Latin America, but now includes impact evaluations of programmes in Sub-Saharan Africa. This book marks the rise of social protection in Africa since the turn of the century, and shows how evidence has contributed to the policy dialogue between national governments, international donors, researchers and implementing partners leading to this rise. Building on the 2010 Yaoundé Tripartite Declaration to install national social protection floors, the number of social protection programmes in Sub-Saharan Africa has tripled in the last two decades, with more and more programmes being funded by national governments instead of international donors.

Representatives of African governments in the workshop underlined the importance of evidence in this shift. As one official put it: “In Malawi, evidence has helped to install the Social Cash Transfer Programme […] The impact evaluation is my Bible”. However, the limited use of evidence is also acknowledged, and a different official pointed out that: “evidence had a backseat in the way we were doing things, but now I realize that it should be put in the forefront. You cannot create a social protection policy without evidential support”.

…to improvement: horizontal and vertical expansion

Backed by evidence or not, the rise of social protection continues. With the number of programmes increasing, challenges lie in upscaling, integrating and increasing coverage.

According to World Bank’s The State of Social Safety Nets 2018, in terms of spending on safety nets as a percentage of GDP, Sub-Saharan Africa almost heads the list, with Europe and Central Asia the only regions with higher relative spending. However, this figure is misleading: comparing absolute spending (as per capita expenditure) between regions, the median annual spending on safety nets in Sub-Saharan Africa is only USD 16 PPP, bringing up the rear. Looking at coverage, Sub-Saharan Africa also trails, with only 24% of its population receiving any type of formal social protection, including labour programmes. Moreover, between country differences are large. The Seychelles, Mauritius, South Africa, Namibia and Lesotho together have higher annual spending on social safety nets than all other countries in Sub-Saharan Africa combined. Coverage of the poorest quintiles are as low as 2% for countries like Rwanda, Burkina Faso and Zimbabwe. While the number of households receiving cash transfers has increased tremendously in the past decade, there remains a huge challenge in the horizontal expansion of social protection, including increasing equity between regions and social groups.

Another challenge is how to increase the benefits of programmes, including through the integration of various interventions. While old age pensions exceed USD 100 per month in various countries, other cash transfers can be as smallas USD 8 per household in other countries. A key challenge, therefore, is to increase transfer sizes and avoid households falling back into poverty when they ‘graduate’ from programmes and lose entitlements.

The rise of cash+ programmes

The most notable development we see is the start of integrating cash transfers with other social protection programmes or social policies (cash+ programmes). This is essential for three main reasons: first, the rise of social protection has led to a highly fragmented landscape, where programmes overlap and exclude some people. Integrating efforts can result in more efficient resource allocation. Second, integrated approaches can benefit those with multiple constraints (such as a lack of income combined with ill health) and lift them out of poverty. Such sequential, multifaceted programmes have the potential to lift the extreme poor out of poverty. Third, establishing linkages between cash transfers and other social policies also enables strategic linkages between various ministries and their objectives. This, in turn, can increase support and invoke additional investments in social protection under various umbrellas.

While countries like Ethiopia (through its Productive Safety Net Programme) and Tanzania (through its Productive Social Safety Net) have integrated cash transfers with public works programmes, the number of integrated approaches is limited at the national level. However, recently, various new cash+ initiatives have commenced:

- in Mali, cash transfers are combined with asset transfers (livestock and agricultural inputs) to combat food insecurity

- in Burkina Faso, cash transfers are combined with parental coaching, education, water, sanitation and hygiene and other interventions for improving child development

- in Addis Ababa, Ethiopia, cash transfers and public works are combined with the promotion of employability and the strengthening of institutions to fight poverty in the context of urbanization

- in Malawi, cash transfers are aligned with interventions for nutrition

- in Mozambique, child grants are combined with nutritional support and individual care plans

This shift towards cash+ is certainly commendable and marks a multidimensional approach towards poverty. However, it poses new (and old) challenges for effective and inclusive design and implementation. For instance, more than before, there is a need to evaluate the conditions under which interventions are complementary. As shown by the research project ‘Social and Health Policies for Inclusive Growth‘, the complementarity of programmes is not a given, but depends on adequate design and implementation.

Also, gaining political support for integrated programmes is challenging and conditional on the support of the various objectives of governments. And while integrated programmes are more likely to support vulnerable groups, a close eye needs to be kept on their inclusion. These issues constitute a major challenge for researchers, policymakers and practitioners in the near future. With various conferences on social protection coming up in 2019, there is ample space to discuss these.

Some of the events on social protection coming up in 2019:

– The IFSW European conference ‘Social protection and human dignity

– ILO’s ‘Global social protection week’