Making knowledge work for inclusive development

INCLUDE is an independent knowledge platform funded by the Dutch Ministry of Foreign Affairs since 2012. INCLUDE promotes and facilitates evidence-based policymaking on inclusive development, with a focus on Africa. We do this through our three pillars: Research, Knowledge Exchange and Policy Dialogues. Our platform members play a central role in the knowledge platform. The majority are African experts in the field of development, and they leverage their lived experiences, expertise and relevant networks to inform the strategic direction of the platform.

Click to see where we work- African Policy Dialogues (Past Editions)

- Apiculture

- Boosting Decent Employment for Africa's Youth

- Digital divides or dividends? Including basic services is Africa's digitalisation agenda

- Equity in COVID-19

- Green jobs and the future of work

- Growth Sectors for Youth Employment

- Inclusive agripreneurship in Africa

- New Roles of CSOs for Inclusive Development

- Research for Inclusive Development in Sub-Saharan Africa

Latest News & Blogs

Our research programme on the digitalisation of basic services in Africa explored how digitisation relates to inclusion. As more and more public services are digitalised governments must be cognisant of the exclusion that can occur, specifically within poor and vulnerable groups.

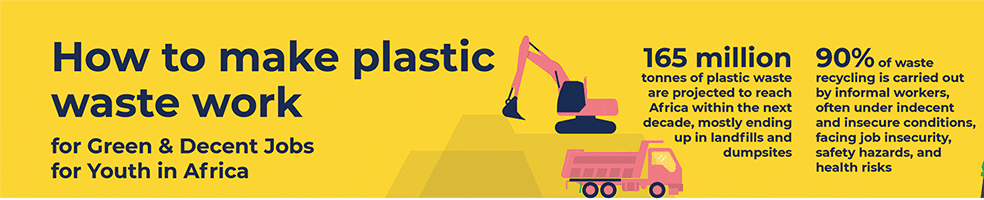

Plastic waste recycling presents an opportunity to create sustainable jobs while benefiting the environment. But the question remains, how can stakeholders contribute to a conducive waste recycling ecosystem, unlocking its green job potential among Africa’s youth? We are excited to present an infographic showcasing the pathways and recommendations for Green & Decent Jobs for Youth in Africa.

This blog is part of a research project on the opportunities for decent work for youth in Africa’s Waste Recycling Sector, in collaboration with the Challenge Fund for Youth Employment (CFYE). Waste management in Africa is a major challenge for sustainable and inclusive development. Due to poor management, 90% of the waste generated in Africa is disposed of in landfills and uncontrolled dumpsites with severe consequences for the environment and people working in the waste management sector.

We are happy to announce the continuation of our research partnership with the Challenge Fund for Youth Employment (CFYE), focusing on decent youth employment in the context of the Green Economy transition in Africa. Building on the insights from last year’s research report, this project will further explore the potential for green jobs creation by looking at the waste recycling sector in Africa, continuing our research into Green Jobs as a possible solution for Africa’s increasing youth population.

We are happy to announce the start of a new project focusing on youth employment in low-carbon transitions in Africa.

Latest Publications

Latest Events

On April 22nd we celebrate Earth Day, with this year’s theme being Plastics Vs Planet. As a result, CFYE, INCLUDE and VSO will organize a webinar that focuses on strengthening youth voices in promoting green solutions and livelihood opportunities in the waste sector in Kenya.

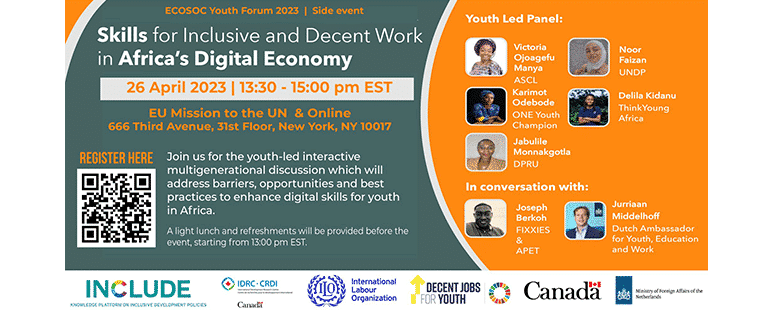

This UN 2023 ECOSOC Youth Forum side event builds on INCLUDE’s evidence synthesis paper Digital Skills for Youth Employment in Africa, recently published in the context of the Boosting Decent Employment for Africa’s Youth research programme.

Concerned with the implications of COVID-19 for inequalities in Africa, the INCLUDE Platform put out…

This event is an in-country dissemination workshop presenting the findings of the research on youth…

The Economic Policy Research Centre in conjunction with the African Economic Research Consortium (AERC) and…